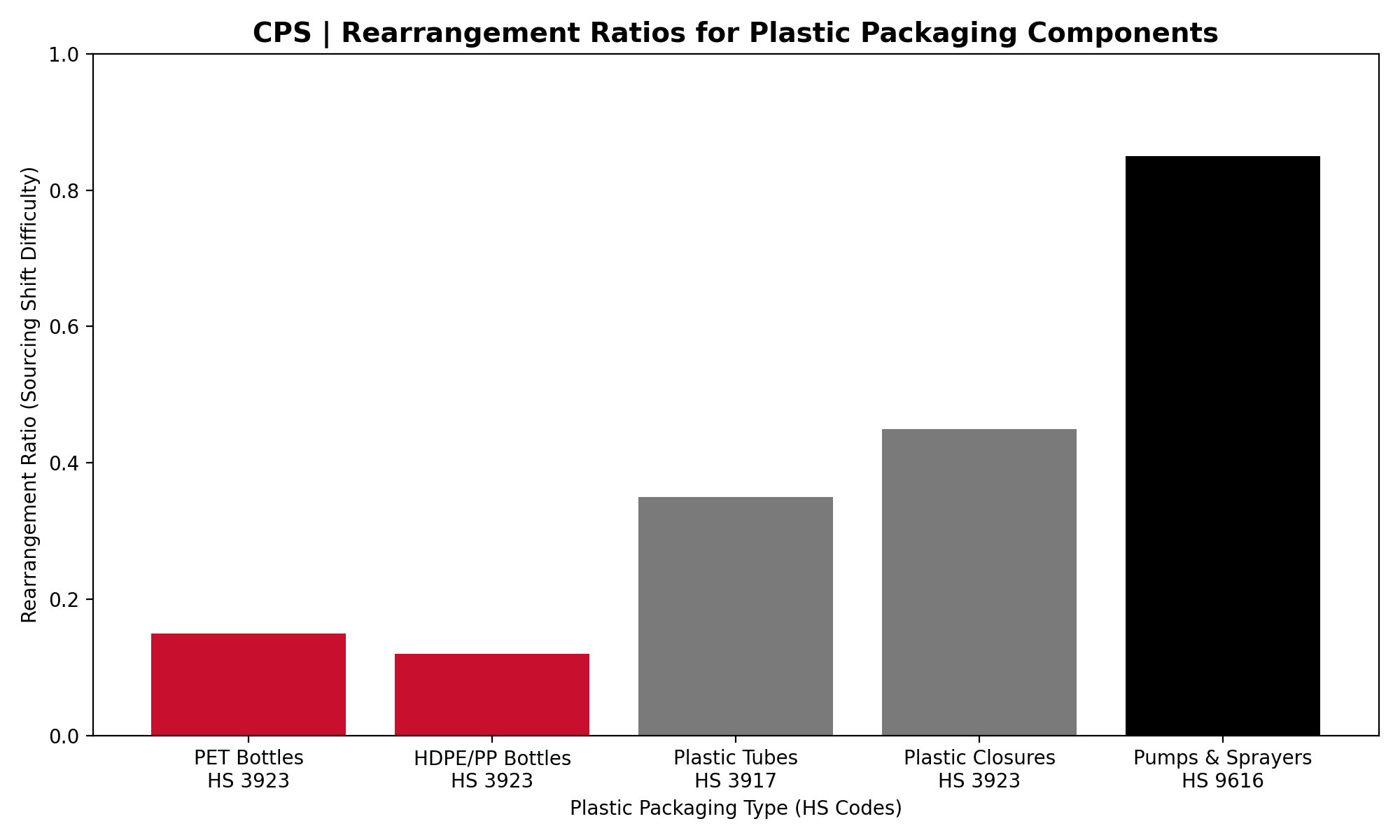

The chart shows increasing difficulty of shifting sourcing.

Lower ratios = easier to rearrange

Higher ratios = strategically constrained.

A practical guide to supply resilience in global packaging.

For years, packaging professionals have quietly understood what recent trade disruptions have made unmistakably clear: Not all packaging responds the same way to global shocks.

Tariffs rise. Geopolitical alliances shift. Supply chains reconfigure. And suddenly, ahumble bottle behaves very differently from a spray pump. Recent global trade analysis methods by McKenzie have introduced a helpful concept called the “rearrangement ratio”. This is a way to measure how difficult it is to shift sourcing away from a particular country for a given product. In simple terms: If the world has plenty of alternative supplies, change is easier. If it does not, things get complicated. Quickly.

In packaging, this distinction profoundly matters.

While packaging is often spoken of as a single category, it is in fact a family of very different products, each with its own supply logic, economics and vulnerabilities.

Packaging Isn’t One Thing–It’s a Portfolio

From a trade and sourcing standpoint, packaging breaks down into five core material families:

- Plastic (including substitutes)

- Glass

- Metal

- WoodFiber

- Multi-material systems

Each behaves differently when the world gets noisy.

Understanding these differences is no longer academic, it is now a commercial advantage.

Plastics: Flexible, Until It Isn’t

Plastic bottles and jars are the great workhorse of packaging, PET, HDPE, and PP containers are widely manufactured across the Americas, Europe, Asia and beyond. As aresult, they are often among the easiest packaging to rearrange when tariffs rise or supplies shift.

However, plastic’s reputation for flexibility ends the moment you move beyond simple containers.

Plastic tubes, specialty closures, multi-layers and complex molded parts require:

. Specialized tooling

. Tighttolerances

. Decoration

. Barrier technologies

At that point, plastic begins behaving more like contract manufacturing than a commodity.

Takeaway:

Plastic containers are adaptable. Plastic systems are strategic.

Glass: Timeless

Glass carries prestige, permanence and tradition.

While glass is produced globally, its economics remain stubbornly regional. Furnaces are capital-intensive, capacity is not easily redeployed, moving heavy, fragile containers across oceans is expensive.

That means that glass, despite its ubiquity, is often harder to rearrange quickly than people expect.

Takeaway:

Glass doesn’t pivot. It doesn’t simply relocate.

Metal: Substitutable on Paper, sticky in Practice

Steel and aluminum containers appear simple. In reality, metal packaging is often deeply tied to:

. pecific converting lines

. Linings and coatings

. Customer filling equipment

While alternative suppliers exist globally, the friction lies in qualification, compatibility and contract structures.

Metal can be rearranged, but rarely overnight.

Takeaway:

Metal can move. Engineers first have their say.

WoodFiber: The Quiet Champion of Flexibility

Paperboard cartons, corrugate, rigid boxes.Wood fiber packaging is the unsung hero of supply resilience.

. Widely produced

. Often regionally sourced

. Less capital intensive to shift

. Increasingly aligned with sustainability goals

From a trade perspective,wood fiber is often the most rearrangeable packaging material in a portfolio.

Takeaway:

If you need fast resilience,wood fiber is your friend.

Multi-Material Systems: Where Supply Chains Become Ecosystem

If bottles are commodities, multi-material packaging is an ecosystem.

For instance, a single fine mist sprayer may involve:

. Multiple plastics

. Springs

. Valves

. Seals

. Assembly precision

. Tooling dependency

. Performance validation

And critically, the global supply of pumps and sprayer manufacturing is still heavily concentrated in a small number of countries.

That makes these items among the hardest packaging components to rearrange, regardless of how small or inexpensive they appear on a bill of materials.

Takeaway:

Multi-material packaging are not simple components. They are strategic assets.

Why This Matters for Brand Owners

Many brands assume that packaging risk is simply about “where something is made”.

In reality, it’s about:

. How specialized it is

. How widely it is produced

. How easily it can be validated elsewhere

. And, how quickly manufacturing contracts and tooling can shift.

Two products may both be plastic, but one may pivot in 30 days and the other in 30 months.

That difference can decide whether a product launch proceeds, stalls or disappears quietly.

The Strategic Packaging Advantage

In today’s environment, resilient packaging strategies are built on three principles:

- Segment Your Packaging by Rearrangement Difficulty

Not all packaging deserves the same sourcing approach. - Design for Substitutability Where Possible

Standardize neck finishes, reduce proprietary closures, simplify material mixes. - Treat Complex Components as Strategic Assets

Pumps, sprayers, closure and multi-material items deserve governance, not just procurement.

A New Role for your Packaging Partners

The era of “just source it cheaper” is ending.

The future belongs to packaging partners who can:

- See trade risk before it hits pricing

- Design packaging architecture that has flexibility

- Guide brands through material geography and lifecycle decisions

Not merely suppliers. Strategic navigators.

At Creative Packaging Solutions, this is exactly where we focus. Help brands build packaging systems that are not only beautiful and functional but resilient by design.

In a rearranged world, the smartest packaging doesn’t just hold your product.

It protects your business.